BECOME OUR DISTRIBUTOR

Join us and become an Authorized AlorAir distributor!

70 PPD at Saturation, 35 PPD@AHAM

1000 sq.ft

Pump drainage/Gravity drain

15.35 × 11.2 × 11.4 in

70 PPD at Saturation, 35 PPD@AHAM

1000 sq.ft

Gravity drainage

15.35 × 11.2 × 11.4 in

113 PPD at Saturation, 53PPD@AHAM

1200 sq.ft

Gravity Drainage

12.2"D x 19.2"W x 13.3"H

120 PPD at Saturation, 55 PPD@AHAM

1300 sq.ft

Gravity Drainage

12.2'' D X19.2'' W X13.3'' H

120 PPD at Saturation, 55 PPD@AHAM

1300 sq.ft

Gravity Drainage

12.2"D x 19.2"W x 13.3"H

120 PPD at Saturation, 55 PPD@AHAM

1300 sq.ft

Pump drainage/Gravity drain

12.2" D X19.2" W X13.3" H

198 PPD at Saturation, 90 PPD@AHAM

2600 sq.ft

Pump Drainage

15.2" D x23.2" W x17.7" H

198 PPD at Saturation, 90 PPD@AHAM

2600 sq.ft

Gravity Drainage

15.2" D x23.2" W x17.7" H

198 PPD at Saturation, 90 PPD@AHAM

2600 sq.ft

Pump Drainage

15.2" D x23.2" W x17.7" H

220 PPD at Saturation, 100 PPD@AHAM

2900 sq.ft

Pump Drainage

14.7" D x 23.8" W x 17.9" H

235 PPD at Saturation, 120 PPD@AHAM

3300 sq.ft

Pump Drainage

14.7"D x 23.8" W x 17.9" H

110 PPD at Saturation, 50 PPD@AHAM

1300 sq.ft

Pump Drainage

14" D x 17" W x 23.1" H

190 PPD at Saturation, 90 PPD@AHAM

2600 sq.ft

Pump Drainage

21.2" D×22" W×38" H

270 PPD at Saturation, 125 PPD@AHAM

3000 sq.ft

Pump Drainage

22.3" D×23.6" W×39.7" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

21.2" D×22" W×38" H

264 PPD at Saturation, 125 PPD@AHAM

3000 sq.ft

Pump Drainage

26.1" D x15.5" W x17.6" H

264 PPD at Saturation, 125 PPD@AHAM

3000 sq.ft

Pump Drainage

26.1" D x15.5" W x17.6" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

21" D×11.6" W ×17.3" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

21" D×11.6" W ×17.3" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

22.8" D ×13.7" W ×17.3" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

22.8" D ×13.7" W ×17.3" H

235 PPD at Saturation, 120 PPD@AHAM

3300 sq.ft

Pump Drainage

14.7"D x 23.8" W x 17.9" H

Yes

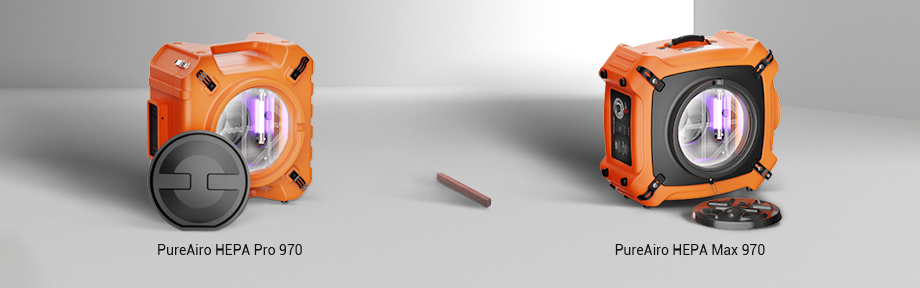

270-750 CFM

1100 sq.ft

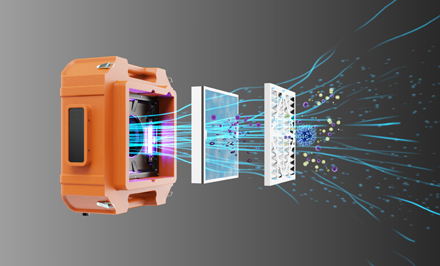

MERV-10 filter and HEPA/activated carbon filter

Yes

270-550 CFM

800 sq.ft

MERV-10 -filter and HEPA/activated carbon filter

No

270-550 CFM

800 sq.ft

MERV-10 filter and HEPA/activated carbon filter

Yes

270-750 CFM

1100 sq.ft

MERV-10 filter and HEPA/activated carbon filter

Yes

270-550 CFM

800 sq.ft

MERV-10 filter and HEPA/activated carbon filter

No

270-550 CFM

800 sq.ft

MERV-10 filter and HEPA/activated carbon filter

No

270-550 CFM

800 sq.ft

MERV-10 filter and HEPA/activated carbon filter

Built-in UV-C light and lonizer

270-600 CFM

800 sq.ft

MERV-10 Filter and HEPA/Activated Carbon Filter

Yes

800-2000 CFM

2500 sq.ft

MERV-8 Filter and H13 Clapboard Filter

No

800-2000 CFM

2500 sq.ft

Pre-filter and HEPA filter

Yes

800-2000 CFM

2500 sq.ft

Pre-filter and HEPA filter

Yes

800-2000 CFM

2500 sq.ft

Pre-filter and HEPA filter

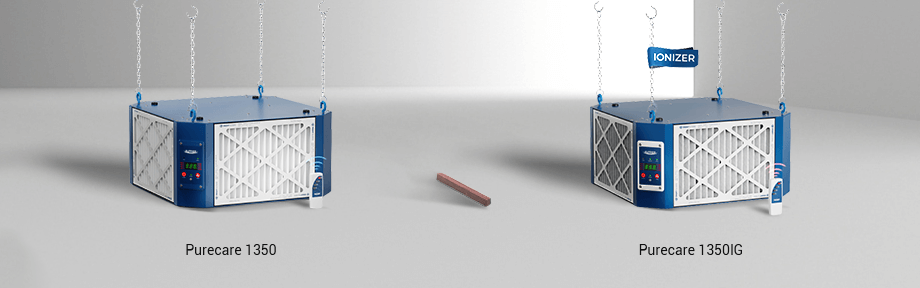

No

1050-1350 CFM

69 DBA

4 X MERV-11

Yes

1050-1350 CFM

69 DBA

4 X MERV-11

No

1100 CFM

66 DBA

5-Micron Filter (Outer), 1-Micron Filter (Inner)

Yes

1100 CFM

66 DBA

5-Micron Filter, 1-Micron Filter

No

500 CFM

61 DBA

5-Micron Filter, 1-Micron Filter

Yes

500 CFM

61 DBA

5-Micron Filter (Outer), 1-Micron Filter (Inner)

3000cfm

2.3 Amps

2-Speed Control

20.1" D x 20.1" W x 16.1" H

950 CFM

1.8 Amps

8-Speed Control

21.6" D x17.3" W x9.8" H

180 PPD at Saturation, 85 PPD@AHAM

2300 sq.ft

Pump Drainage

21" D×11.6" W×17.3" H

264 PPD at Saturation, 125 PPD@AHAM

3000 sq.ft

Pump Drainage

26.1" D×15.5" W×17.6" H

275 PPD at Saturation, 140 PPD@AHAM

3800 sq.ft

Pump Drainage

33.9" D×18.1" W×19.3" H

275 PPD at Saturation, 160 PPD@AHAM

4000 sq.ft

Pump Drainage

31.9" D ×20" W ×18" H

115 V 60 Hz; 0.7 A

720 CFM

55 DBA

5 to 80% RH

115 V 60 Hz; 0.51 A

540 CFM

55 DBA

5 to 80% RH

115 V 60 Hz; 0.25 A

260 CFM

40 DBA

5 to 80% RH

100 to 230V AC, 0.8A

0-240 CFM (Air-out)

0-48 dBA

20 to 100% RH

115 V 60 Hz; 0.25 A

260 CFM

40 DBA

5 to 80% RH

115 V/ 60 Hz, 0.51 A

540 CFM

55 dBA

5 to 80% RH

115 V/ 60 Hz, 0.7 A

720 CFM

55 dBA

5 to 80% RH

115V/60 Hz, 0.38 A

300 CFM

40 dBA

10-80%

115V/60 Hz, 0.52 A

570 CFM

55 dBA

10-80%

115V/60 Hz, 0.65 A

780 CFM

55 dBA

10-80%

115 V 60 Hz; 0.38 A

300 CFM

40 DBA

1 to 99% RH

115 V/ 60 Hz, 0.52 A

570 CFM

55 dBA

1 to 99% RH

115 V/ 60 Hz, 0.65 A

780 CFM

55 dBA

1 to 99% RH

20,000 BTUs

250 CFM

Up to 430 Sq.Ft.

PTC heating wires and Remote Control

SUBSCRIBE TO OUR NEWSLETTER!

We’re inspired by people like you to make technology better.

FIND OUT MORE ABOUT OUR PRODUCTS!

Visit this page for PDF, images, and other relevant material.

SUBSCRIBE TO OUR NEWSLETTER!

We’re inspired by people like you to make technology better.

FIND OUT MORE ABOUT OUR PRODUCTS!

Visit this page for PDF, images, and other relevant material.

.png)

ANNOUNCEMENTS

ANNOUNCEMENTS

ANNOUNCEMENTS

ANNOUNCEMENTS

ALORAIR Will Create New Miracles in 2023!

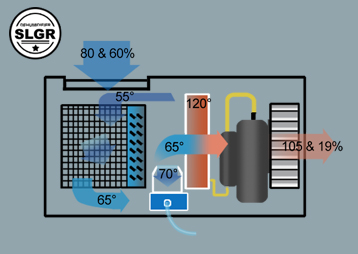

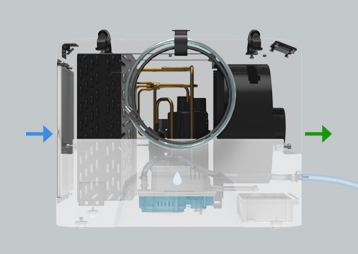

Our new Air Scrubbers are equipped with a UV-C Light Disinfection System designed to tackle the threat of COVID-19 and other airborne diseases.

Capacity (115V/60Hz):35 Pints/Day@AHAM (80°F-60%); 70 Pints/Day@saturation (90°F,90%); Airflow: 115 CFM

Capacity (115V/60Hz): 55 Pints/Day@AHAM (80°F-60%); 120 Pints/Day@saturation (90°F, 90%); Airflow: 130 CFM, 230 CMH.

Capacity (115V/60Hz):90 Pints/Day@AHAM (80°F-60%); 198 Pints/Day@saturation (90°F, 90%); Airflow:210 CFM, 350 CMH.

Capacity (115V/60Hz):120 Pints/Day@AHAM (80°F-60%); 235 Pints/Day@saturation (90°F, 90%); Airflow: 290 CFM

Capacity (115V/60Hz): 50Pints/Day@AHAM (80°F-60%); 110 Pints/Day@saturation (90°F, 90%); Airflow:150CFM, 250 CMH.

Capacity (115V/60Hz):85Pints/Day@AHAM (80°F-60%); 180 Pints/Day@saturation (90°F, 90%); Airflow:210 CFM, 350 CMH.

Capacity (115V/60Hz): 125Pints/Day@AHAM (80°F-60%); 264Pints/Day@saturation (90°F, 90%); Airflow:300CFM, 510 CMH.

Capacity (115V/60Hz): 85Pints/Day@AHAM (80°F-60%); 180Pints/Day@saturation (90°F, 90%); Airflow:210CFM, 350 CMH.

Power (115V/60Hz): 2.5Amps; Size For:5500 CU.FT; Airflow Range: 270-550CFM.

Power(115V/60Hz): 1.5 Amps; Size For: 1700 Sq.Ft; Airflow Range: 1050-1350 CFM

Power (115 V/60 Hz): 0.7 Amps; Size For: 5600-7400 Cu.Ft; Airflow: 720 CFM

We take the next level in restoring and preventing water damage in your beloved space. Our products not only fight molds and fungus, but also complications caused by unpredicted water disasters.

PRODUCT REGISTRATION & Support

Enter your email to receive Exclusive Offers in your inbox.

ALORAIR Solutions Inc. AlorAir was established based on the philosophy of providing the industry with leading features, performance, value and outstanding customer support. View our Privacy Policy | Terms & Conditions